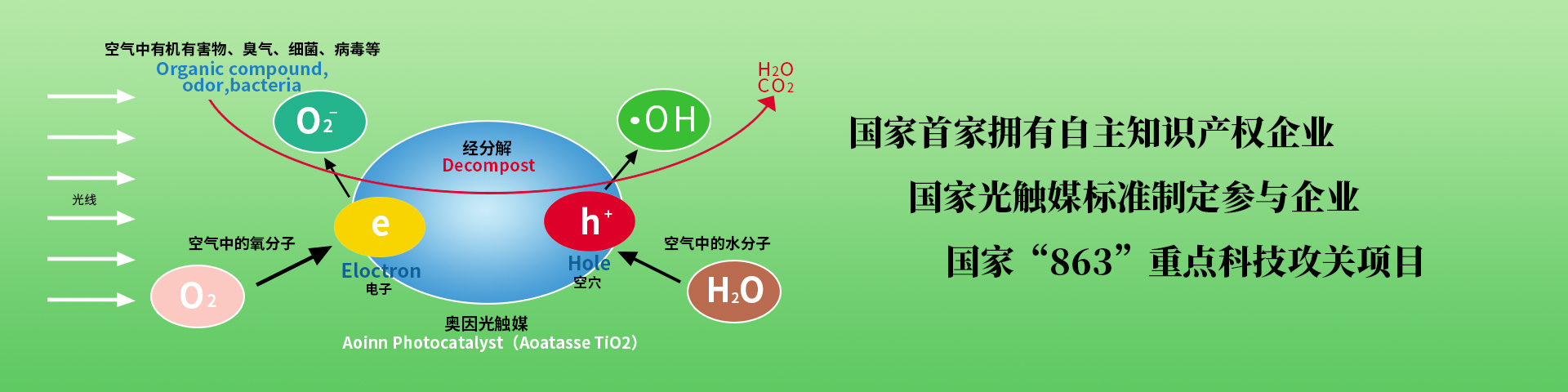

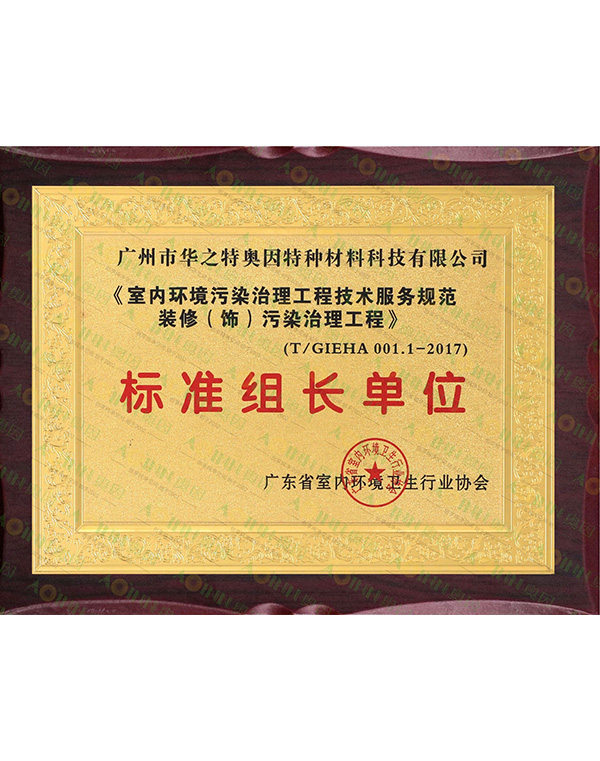

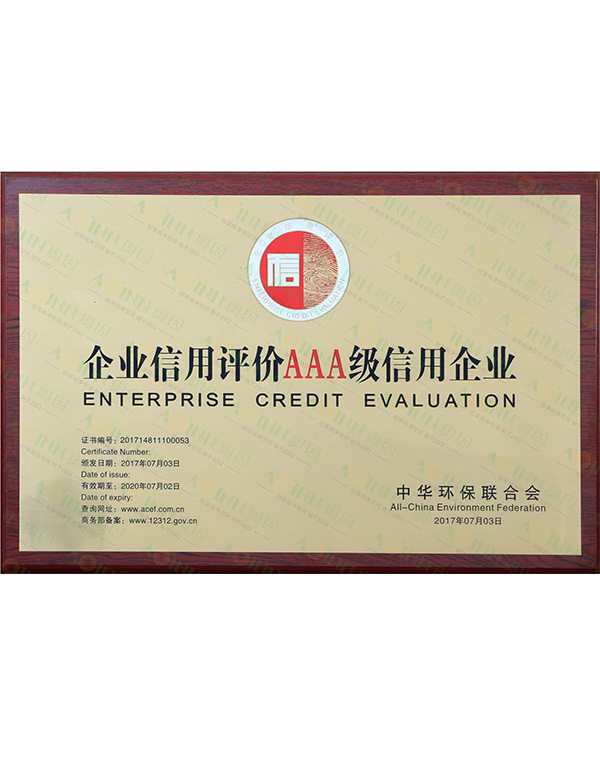

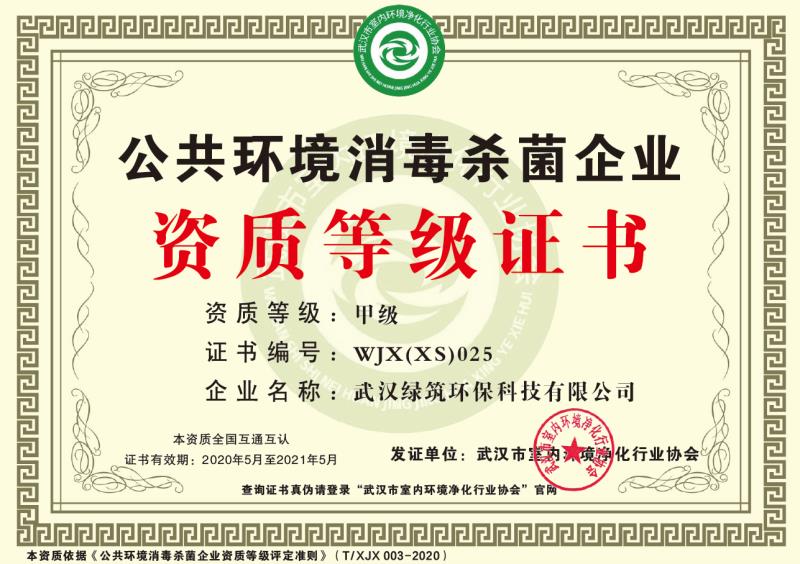

亚娱电竞(集团)有限公司,系光触媒行业的佼佼者—广州市奥因环保科技有限公司在湖北的战略合作伙伴暨服务品牌。是由长期从事有害气体检测和治理的专业团队打造,绿筑环保,致力于室内空气治理。自身对室内空气检测及治理拥有丰富的经验。

绿筑环保室为室内空气治理提供详细完整的解决方案。专业为办公楼、家居、学校、酒店、KTV、汽车等场所提供室内空气检测、室内空气治理与装修除异味。

绿筑环保秉承着“健康生活始于健康呼吸”的理念,凭借精良的检测治理设备,专业化的工程队伍,合理的报价,以及......

了解更多+

绿筑环保除甲醛公司主营武汉室内空气检测治理!